All You Need to Know About the State of Crypto Exchanges in 2024

As we hurtle through 2024, the crypto market continues to be a rollercoaster ride that would make even the most seasoned theme park enthusiast dizzy. From the approval of Bitcoin ETFs to the recent surge in memecoins, the market has witnessed seismic shifts that are reshaping the future of digital assets.

Let's dive into the state of crypto exchanges in 2024, explore the major trends, and how they impacted crypto prices, and peek into what the future holds for this rapidly evolving industry.

Buckle up, fellow TOKEROnauts – we're initiating the launch sequence! 🛸

The Evolution of Crypto Exchanges in 2024

The year kicked off with a bang 💥 as the SEC approved Bitcoin ETFs, marking a watershed moment for cryptocurrency adoption.

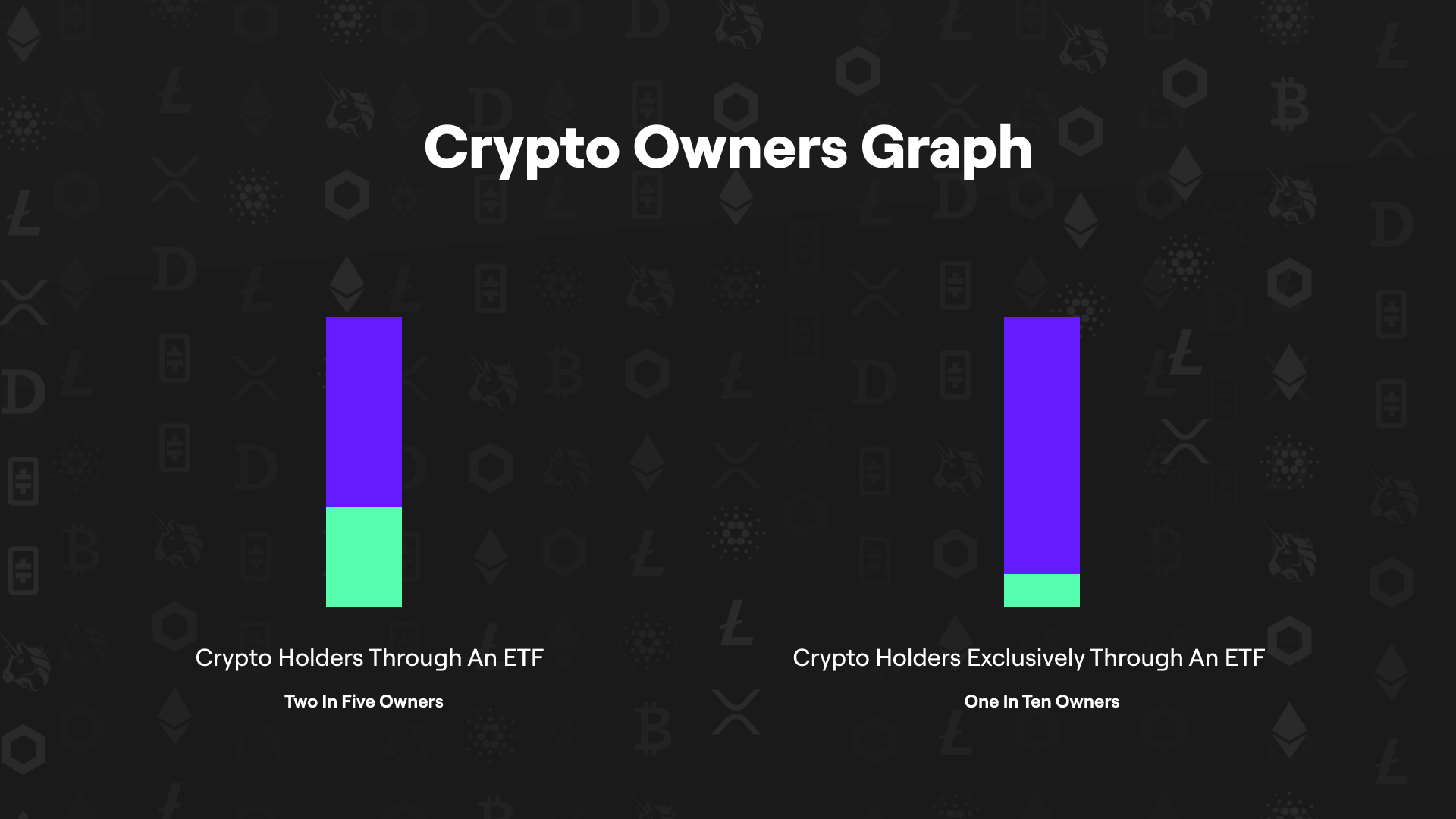

This move opened the floodgates for institutional investors, with nearly two in five (37%) cryptocurrency owners in the US now holding some crypto through an ETF. More importantly, over one in ten (13%) own crypto exclusively through an ETF, suggesting a new wave of investors entering the space through these regulated products.

However, the regulatory landscape remains as complex as charting a course through an asteroid field.☄️

In a stark reminder of the ongoing scrutiny, German authorities shut down 47 crypto exchanges as part of a global cybercrime sweep. This action underscores the growing emphasis on compliance and security in the crypto space, forcing exchanges to up their game in terms of anti-money laundering (AML) and know-your-customer (KYC) procedures. As the crypto market matures, regulators are watching with eagle eyes and their rules are as changing as the crypto prices.

For exchanges, their message is clear: play by the rules or get shown the door.

Speaking of playing by the rules, 2024 has seen some of the brightest crypto stars face the music for their past misdeeds. In March, Sam Bankman-Fried, the once-golden boy of crypto and founder of FTX, got burnt to 25 years in prison for fraud.

But SBF wasn't the only big name that faced the long arm of the law. In April, Changpeng Zhao, the founder of Binance – the world's largest crypto exchange, got a four-month prison sentence. Binance itself had to cough up a whopping $4.3 billion fine in settlements to the SEC.

These high-profile cases are just the tip of the meteor.

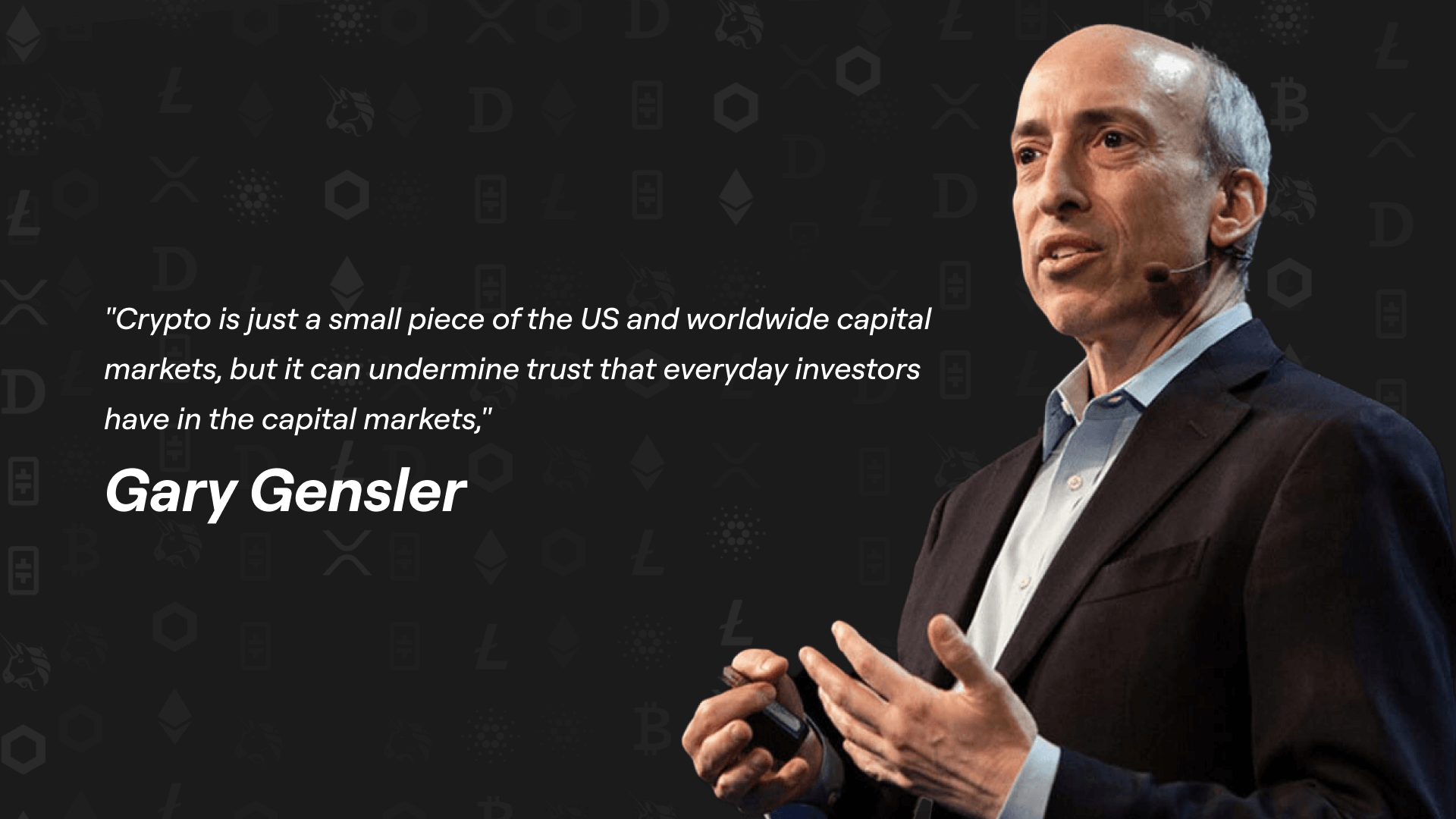

The SEC, under the leadership of Gary Gensler, has been on a regulatory rampage, taking a record 46 enforcement actions against crypto firms last year.

At TOKERO, we've always prioritized compliance and security. Our advanced features and enhanced security measures ensure that our users can trade with confidence, knowing they're protected by the best defenses in the galaxy. 💪🌟

Despite these challenges, adoption rates have remained steady or even increased in some regions. The United States and United Kingdom have maintained adoption rates of 21% and 18% respectively, while France saw a slight increase from 16% to 18%.

And the good news is CZ is back from jail now!

Just a few days ago, on the 27th of September, he was freed and is now already posting on X. Among his first words to the masses, he emphasized the importance of education for the future of crypto as he stated he will "dedicate more time and funding to charity (and education)", via his Giggle Academy where he aims to aid children under 13 years old in developing countries who do not have access to education, offering basic knowledge in fields such as mathematics, science, physics, biology or finance.

The free academy also intends to cover "topics current schools don't teach," such as negotiations, finance, entrepreneurship, sales, legal, accounting, blockchain, and artificial intelligence.

At TOKERO, we're aligned with this vision. We believe that exchanges that successfully balance educational innovation and compliance will thrive in this dynamic market. That's why we're leading by example, using our token to power education through a complex business ecosystem (360 degrees) and an education and career program where you can develop as an individual from a simple beginner user to a professional, entrepreneur, or investor.

On the flip side in terms of crypto adoption, we've seen some exciting developments with established players expanding their offerings. PayPal made waves by enabling business accounts to buy, sell, and hold crypto, potentially opening up new avenues for B2B transactions in the digital asset space. Meanwhile, Robinhood and Revolut are exploring stablecoin offerings, signaling a move towards more diverse and stable crypto products.

Market Trends Shaping Crypto Exchanges

The crypto market cap has seen significant fluctuations this year, currently standing at $2.10 Trillion at the moment of writing (2nd of October 2024), with Bitcoin dominance at 56.70%, while just 4 days ago (on 28th of September) it stood proudly at $2,29 Trillion. This volatility is exemplified this early October when geopolitical tensions between Iran and Israel led to a sharp 8% drop in the total crypto market cap.

The Trump Bull?

In an unexpected twist that's got the world buzzing, former President Donald Trump has launched into the crypto space, making quite the stellar entrance with his World Liberty Financial project, declaring his ambition to make the U.S. the global leader in digital assets. Trump's promises to create a strategic national bitcoin stockpile and brand America as the "crypto capital of the planet" have resonated with many crypto enthusiasts. His speech at a major Bitcoin conference in Nashville, where he criticized current regulations and vowed to fire SEC chair Gary Gensler, sent Bitcoin soaring to $70,000 back in July.

However, the long-term impact of Trump's crypto-friendly agenda remains uncertain. While his promise to ease regulatory pressure and replace anti-crypto officials, like SEC Chair Gary Gensler, with industry advocates has been met with enthusiasm, questions persist about the feasibility of these plans. The volatile nature of cryptocurrency markets, coupled with the regulatory challenges Trump may face, leaves investors and enthusiasts speculating whether his proposals can lead to sustained growth in the sector, or if they are merely a political move.

If there's one thing 2024 has taught us, it's that the crypto market is full of surprises.

Maybe the Meme Bull?

While Bitcoin and Ethereum continue to be the heavyweight champions of the crypto space, we've seen some unexpected (meme)ships challenging the domain. 🛸

Memecoins, once dismissed as a joke, have proven they're here to stay. With the memecoin market now valued at over $41 billion, it's clear that investors have an appetite for the weird and wonderful. At the core of memecoin success is the internet meme culture, which has rapidly evolved from what once seemed like a niche internet joke into a formidable economic phenomenon. Communities are drawn to memecoins not just for potential profits but for the sense of belonging and shared humor that memes provide. Coupled with the viral nature of memes, Reddit communities, and influencer endorsements and now we have a meme cycle.

Take, for example, Iggy Azalea's $MOTHER, a memecoin built around her fan base and internet persona. Or $POPCAT, a coin that taps into the viral "Popcat" meme, recently listed on Kucoin.

As traditional cryptocurrencies like Bitcoin soared past $60,000, traders priced out of the market shifted their focus to these cheaper, more community-driven alternatives. This shift has led to an explosion of interest in memecoins during the spring of 2024, setting the stage for a booming market. The popularity of memecoins continues to rise, with major tokens like Dogecoin ($DOGE) seeing renewed attention. After a long period of consolidation, Dogecoin recently surged by 7.4%, hitting $0.1234—a sign of a potential market revival.

This signals that the memecoin market is heating up, and with exchanges quickly listing these tokens, we can only assume that maybe memes are having their own bull run.

Memecoins have demonstrated that market psychology, community engagement, and viral culture can move markets in ways that defy traditional financial logic. As these playful assets attract a new generation of investors, crypto may become even more intertwined with pop culture and social trends.

However, the sustainability of memecoins remains a topic of debate. Despite their explosive growth, most memecoins are driven by short-term speculation and FOMO (fear of missing out). While this has led to impressive liquidity, it also raises concerns about whether these tokens can provide long-term value.

The rise of memecoins presents both opportunities and challenges for crypto exchanges. On one hand, memecoins drive significant trading volume and attract new, often retail investors, offering exchanges the chance to grow their user base and profits through transaction fees. However, the highly speculative and volatile nature of memecoins poses risks, requiring exchanges to balance the potential for rapid growth with careful risk management. To ensure long-term success and maintain user trust, exchanges must prioritize user safety. This includes conducting thorough due diligence before listing new memecoins, implementing strict vetting processes to avoid fraudulent or "rug-pull" projects, and providing transparent information about the risks associated with speculative investments.

Educating users on responsible trading is crucial and we take it very seriously.

Or the Ordinal Bull?

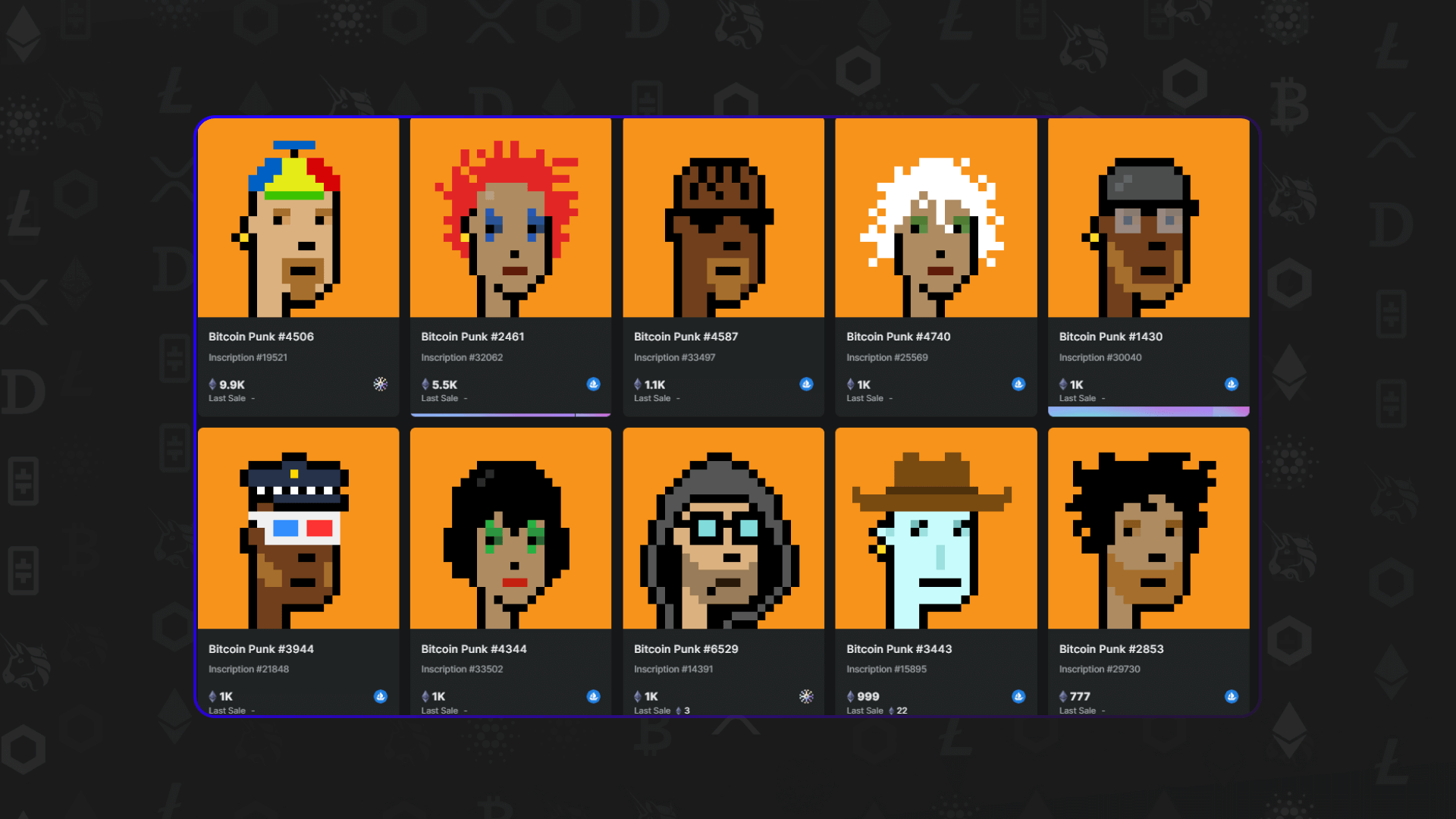

Bitcoin Ordinals have emerged as a significant force in the cryptocurrency market, sparking renewed interest and activity reminiscent of the early days of Bitcoin and NFTs. Their influence extends beyond mere speculation and memes, reflecting a growing market dynamic that traders and exchanges are beginning to take seriously.

Collections like NodeMonkes have seen their floor prices skyrocket to around $13,000, equivalent to 0.2 BTC. Other collections are also seeing significant growth, with platforms like Magic Eden reporting gains and a noticeable shift in market share. Bitcoin has surpassed even Ethereum in NFT trading volume, underscoring the increasing popularity of Ordinals within the NFT space.

The growing interest in Ordinals has not gone unnoticed by cryptocurrency exchanges. This trend has prompted exchanges to consider integrating Ordinals trading, opening up new revenue streams, and attracting a different subset of crypto enthusiasts.

The success of Ordinals may inspire further innovation within the Bitcoin ecosystem, attracting new projects and developers, which would enhance Bitcoin's overall utility and market appeal. Collectively, these factors could create a self-reinforcing cycle of demand and positive sentiment, potentially ushering in a new bullish phase for Bitcoin and the broader crypto market.

What will be the catalyst for the next bull run?

Will it be the political ambitions of figures like Donald Trump rallying support for regulatory reform, the surging popularity of memecoins capturing the spirit of a new generation, or the innovative potential of Bitcoin Ordinals and NFTs reigniting enthusiasm in the market?

What do you think?

Share this article on X and let us know what you think will be the catalyst for the next bull run!

Q4 2024 Market Outlook

As we approach the final quarter of 2024, the crypto market looks about as predictable as a game of Monopoly with your most competitive friends. But let's break down what we know:

Bitcoin's market cap stands strong at $1.2 Trillion, while stablecoins maintain a significant presence with a market cap of $173 Billion.

The approval of options on BlackRock's SPOT Bitcoin ETF by the SEC signals growing sophistication in crypto investment products. This development is likely to attract more institutional investors and could lead to increased liquidity and reduced volatility in the Bitcoin market.

Regulatory developments continue to play a crucial role. The ongoing FTX drama, with court hearings scheduled throughout Q4, serves as a reminder of the importance of robust governance and transparency in crypto exchanges. These proceedings may lead to stricter regulatory oversight, potentially reshaping the competitive landscape among exchanges but we at TOKERO stand strong.

Industry leaders remain optimistic about Bitcoin's future. CleanSpark CEO Zach Bradford expects Bitcoin to reach a peak of just under $200,000 sometime in the next 18 months. This bullish sentiment, if realized, could drive significant activity on exchanges.

Now, whether that prediction is worth its weight in Bitcoin is up to you to decide.

Emerging Players

While established exchanges continue to dominate, new players are entering the scene with innovative offerings. One such potential market shaker is TOKERO.

Our vision is to help people build their best financial version – not by competing with other exchanges but by collaborating with them to provide users with everything they need.

With advanced features, enhanced security, and a user-friendly interface, TOKERO aggregates the 5 most important CEXs via API and corporate accounts. We believe that competition has no place in the crypto space; instead, our focus should be on collaboration to foster greater user adoption, ultimately benefiting everyone involved.

This allows our users to access the best prices and liquidity from multiple exchanges, all through a single, intuitive platform.

But we're more than just an exchange. TOKERO is:

- An Educational Hub: Check out our Academy and guides to go from zero to hero!

- An Onboarding Platform: Learn more about crypto and how to start your journey with our courses.

- A Community: We are not just an exchange with a community, but a community with an exchange. From the beginning, we have been very close to our community and take pride in this. Join our community.

- And even a Lifestyle Brand: Crypto merch, anyone?

Whether you're a seasoned trader or a curious newbie, there's never been a more exciting time to be involved in the crypto space.

Stay informed, stay curious, and most importantly, stay safe out there in the wild west of digital assets.

Time to Level Up!

It's time to supercharge your crypto journey and be part of a revolution in financial education and career development. Click the button below this article to start leveling up!

Don't forget to share this article on X and let us know what you think will be the catalyst for the next bull run!